Projections for Oil & Gas Demand in the EV Era

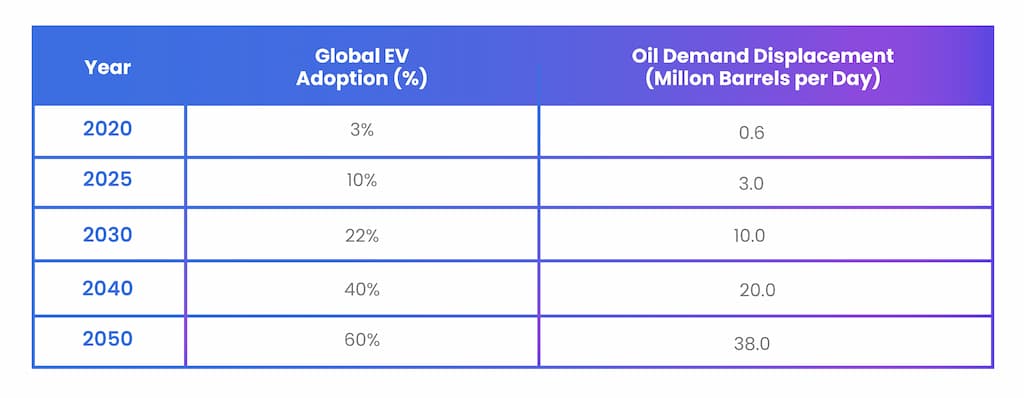

The burgeoning growth of electric vehicles (EVs) presents a potential challenge for the oil and gas industry, with global EV sales expected to hit 10 million by 2025, potentially reducing oil demand by 350,000 barrels per day. This surge in EV popularity could dramatically alter oil consumption patterns, with projections suggesting that by 2040, EVs could displace over 20 million barrels of oil per day.

Amidst such transformative forecasts, some experts have even predicted that oil demand could peak as early as 2023, with a daily displacement of 2 million barrels due to EVs.

Key Trends in EV Adoption and Its Effect on Oil Consumption

The momentum behind EVs is strong as they offer numerous benefits, from lower operating costs to reduced emissions. International entities and governments worldwide are incentivizing their adoption, intensifying the potential effects on oil markets.

However, it’s essential to understand that rising oil demand from developing countries could offset these impacts.

Estimations of current oil demand affected by EVs range between 0.4 to 1.5 million barrels per day. Despite these considerable figures, the U.S. Energy Information Administration (EIA) has projected that EVs will make up only about 25% of world light vehicles by 2050. This growth hints at the unfolding revolution in the transportation sector and the subsequent disruption of the oil market.

Why the Oil & Gas Industry Will Continue to Thrive Despite the Rise in EVs

It’s understandable that one might think the rise of Electric Vehicles (EVs) sounds like a dire prediction for the oil and gas industry. However, reality offers a rather different narrative. Factors like the steady growth of oil demand in developing nations and the persisting preference for gasoline and diesel in certain regions could counterbalance the pressure exerted by the onset of EVs.

Despite the impressive acceleration in EV adoption, the impact on oil demand could be less dramatic than projected. Various complications lie ahead for EVs, including the pressure of reducing prices to compete with their fuel-based counterparts, and scaling up the network of fast-charging stations for greater accessibility. These challenges weaken the argument that EVs could single-handedly disrupt oil demand.

It’s also vital to note that even if we witness a decline in gasoline demand due to EVs, oil production will still be necessary. Why? Because several byproducts derived from the crude oil processing – ranging from asphalt to lubricating oils – are still going to be in demand, irrespective of the popularity of EVs.

- Energy Intelligence Group has predicted that not only will oil demand grow in 2024 but it will continue doing so till the end of the decade.

Projections like the BNEF forecast predict a glut of oil by 2028, resembling the 2014 oil crisis, due to the rapid rise in EVs. However, contrasting views argue that EVs will have near zero impact on oil demand, even long-term. Feeding into this argument, research also shows that oil consumption displaced by EVs is set to rise to just over 20 million barrels per day by 2040. While this seems significant, it may not lead to an oil industry ‘meltdown’ as expected by many.

Ultimately, the impact of growing EV fleet worldwide on global oil demand is likely to be transformative, but not necessarily disruptive. The oil and gas industry, in the foreseeable future, is far from being phased out. Instead, it will continue to evolve and play a crucial role in powering our world.

ShareVault offers a virtual data room solution suitably designed for the oil and gas industry. Hop on a call with us and see for yourself.